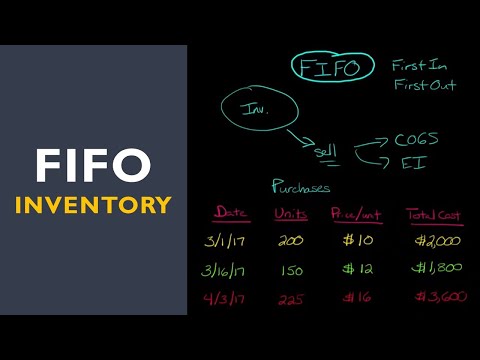

In this video, we're going to talk about fifl, which stands for first-in first-out (FIFO). FIFO is an inventory costing assumption. When we make a sale from our inventory, we need to decide which units will be included in the cost of goods sold and which units will remain in the ending inventory. To better understand this concept, let's use an example. Imagine you have a t-shirt company and you sell custom t-shirts. Let's say you sold 250 t-shirts, all of the same type. Now, let's examine your inventory purchases. You bought 200 t-shirts on March 1st, 150 t-shirts on March 16th, and 225 t-shirts on another date. Since you sold 250 t-shirts, you need to determine which units were sold, considering that they were purchased at different prices. If we knew exactly which 250 t-shirts were sold, we could use the specific identification method and calculate the cost accordingly. However, since all the t-shirts are mixed together in one big pile of inventory, we cannot identify which specific units were sold. Therefore, we need to make an assumption. To resolve this, we use the FIFO method. FIFO assumes that the first units purchased will be the first ones sold. So, when calculating the cost of goods sold and the ending inventory, we will use the cost of the first 250 units purchased, which were bought for $10 each on March 1st and $12 each on March 16th. By following this assumption, we can determine the cost of goods sold and the value of the remaining inventory. This allows us to make accurate financial statements and track our inventory effectively.

Award-winning PDF software

1125-a - valuation methods Form: What You Should Know

The table below provides detailed information to help you meet these requirements. Note: I have not verified each table below with the IRS. They are intended to provide general guidance on the form, and may not be correct. Inventory values: 1. Quantity and Description of Items Sold 2. Total Inventory Value 3. Dollar Amount of Cash Received (including any net capitalization of capitalized items in cash), less (excluding the value of tax paid on cash acquired and/or capitalized) 4. Total Cost (including the value of each capitalized item sold under Section 101(a)(26) or (31)) 5. Adjusted cost of goods sold (including the value of each capitalized item sold under Section 101(a)(26) or (31)) 6. Cost or Price Per Unit Total Gross Revenue or Gross Cost, whichever is greater To estimate the total value of your cash and inventory sales and cash-acquired goods sales, first determine the total inventory value. This can be done either using Section 2 of Form 1125-A, or the Form 2115, which must be used with Form 1120-F, Form 1125-T, or Form 2117, each of which is a separate section. Enter the total inventory value in either of the following two columns, or enter the "Total Cost” field, whichever is closest to your value. If you have inventory that you must sell, enter the number of items sold under Section 2 of Form 1125-A. In addition, estimate what percentage of your total gross sales should be taxable under Section 26 or 32 of the tax code. To compute the amount of tax due, divide the total cost of goods sold by the amount of taxable gross revenue. To compute the number of taxable items, add up the cash received and the purchase price of the capitalized items (if applicable). For example, if an employee buys a television for 150 and then sells it back to the company for 250, 150 × 150 = 100,000 in cash payment received. If an employee is granted 250 in stock options, the employee should enter how much of the value of the share options is taxable. If an employee is granted 500 in stock options, you should enter how much is taxable.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1125-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1125-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1125-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1125-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1125-a - valuation methods